Purchase Office Supplies on Account Journal Entry

Record the journal entries for the following. Accounting Equation for Unearned Revenue Journal Entry.

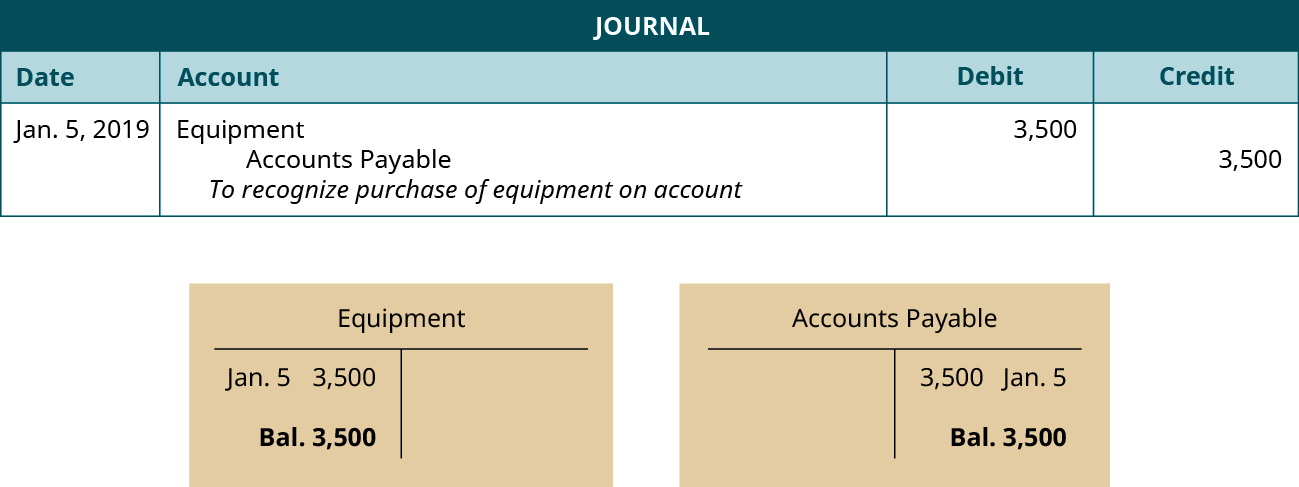

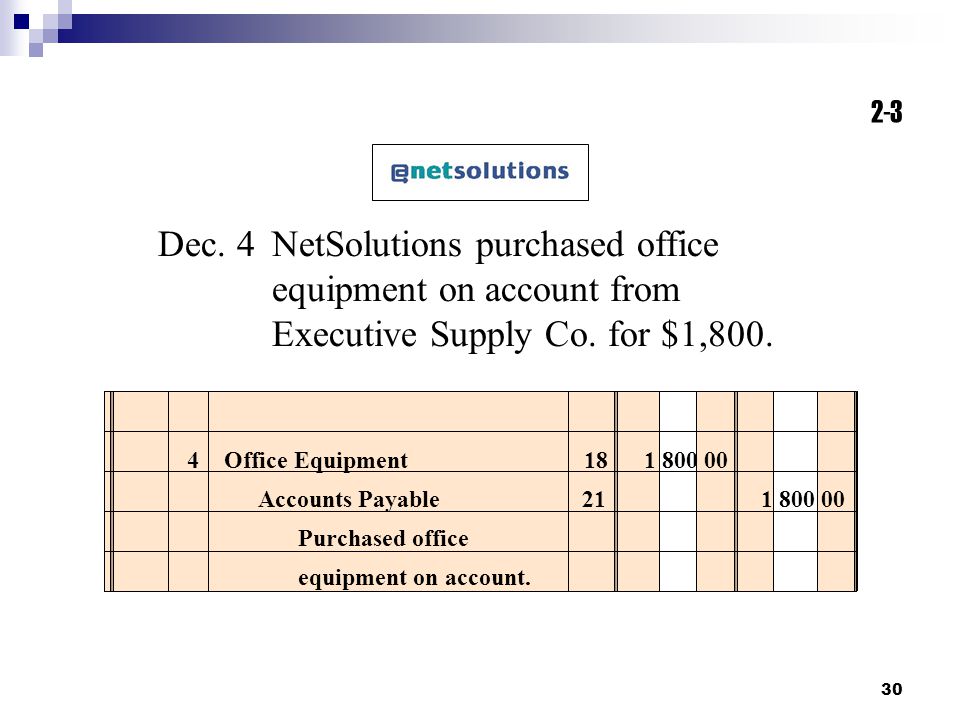

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business.

. The quantity of stock remains the same but the location changes. The stock adjustment may be due to the following reasons. This is useful to transfer the goods from one location to another.

Stock Journal Voucher Stock journal is a journal in which all types of stock adjustments are entered. 1 - Business started with cash 8000 and plant machinery 3000. 4 - Salaries paid 200000 but due 110000.

That is because of lack of knowledge of accounting rules and lack of a guidance from a professional and experienced. Journal entry for issuing check. This is what the journal entry could look like.

For this transaction the accounting equation is shown in the following table. JCC needs to purchase some basic supplies for use around the store such as pens printer paper and staples. Likewise the company can make the journal entry for issuing check by debiting the accounts payable asset or expense account and crediting the bank account.

In business the company usually needs to purchase office supplies for the business operation. Their accountant has set up a separate account for these kinds of purchases called Supplies Expenses. The company may issue the check for various reasons including settling the previous credit purchase purchasing the assets or paying the expenses.

Likewise when it paid cash for supplies it needs to make a proper journal entry based on whether it is on the purchasing date or it is on a later date for settlement the payable it has made on the purchasing date. For example if the purchased item is office supplies expenses are the account that should be recorded. 6 - Depreciation 10 percent on.

Journal entry in TallyERP 9 is one of the simplest things which one can do without any serious efforts if the person knows a little bit of basic rules of accounting Though most of the people feeling unnecessary confusion in Journal Entry itself. However if computers are the items that entity purchase then fixed assets is the account that. 2 - Stock purchase for sale cash purchase 3000 credit purchase 5000 3 - Wages paid 120000 including 20000 relating to a future year.

5 - Sales made for cash 600000 and on credit 800000. Related article How to Closing End Journal Entry. Paid cash for supplies journal entry Overview.

This is true at any time and applies to each transaction.

Purchase Office Supplies On Account Double Entry Bookkeeping

No comments for "Purchase Office Supplies on Account Journal Entry"

Post a Comment